FoodTech potential

The main argument here is how innovation in food technology can increase access to more affordable, ecologically positive and healthier food products in the face of war and pandemic strained food (chain) supplies. The article has three parts; why write now, what solutions are there – with a focus on vertical farming and non animal proteins – and what hurdles need to be cleared to accelerate their adoption in the EU and then globally.

Every year we experience Earth Overshoot Day. It marks the date when „humanity has used all the resources that Earth regenerates during the entire year“. This year it will fall on July 28th and for many countries in the world (e.g. Qatar, USA, Canada and Denmark) this occasion was reached in February or March.

The following food availability statistics will dim the picture further. More than 10% of the world’s population is suffering from hunger everyday, 25% doesn’t have access to healthy diets and according to the Food and Agriculture Organisation of the UN 30% faces moderate to severe food insecurity.

In the face of this, a third of the world’s food wasted or disposed of each year (in the EU it’s 20%, costing over €140 billion or more than Germany’s new defence budget and Adidas’ market capitalisation combined).

Simply growing more is not easy as agriculture already occupies 50% of the world’s habitable land. Two thirds of that is used for livestock (which is the number one reason for deforestation) but the caloric benefit, calculated as ratio of energy input to protein output, is meagre, in fact – 40:1 (chicken, being the most efficient meat is 8:1).

Relying on fish isn’t a viable option as in already in 2018 93% of the global marine stock has been „maximally or overly exploited“ – leading not only to food scarcity but also to biodiversity threats. Stretched as our food producing capacity is, by 2050 food demand -for the world’s forecasted 10 billion humans- will increase by 50% and meat and dairy by 70%.

Lastly, growing the same food sources in controlled environments, that is on aqua and cattle farms, causes water and oxygen depletion. Besides the environmental harms, these practices – especially with the proliferation of antibiotics – results in poor health and a strained healthcare system. Up to 30% of all cancer diagnoses in the EU are linked to poor dietary habits.

What solutions are there

Food innovation is divided into a few sub sectors. AgriTech covers efficient farming to improve agricultural output. For example, it includes light, water and soil optimisation as well as the usage of robotics and drones.

Vertical farms (such as Infarm) are an example of this and their strength lies in producing a bigger food output with less resources. Netherlands is pioneering AgriTech and has managed to produce 20x vegetable output as open field farming with 4x less water.

BioTech combines cellular, genetic and otherwise biological knowledge with technology. One common technique is precision fermentation which ties software driven food design combined with good old fermentation. The technique works by „select[ing] a micro-organism and program[ing] it to produce our desired output (usually a protein) using plant-based inputs“.

In other words, deriving the meat taste using the micro components that make meat without using an animal to do so. It is akin to the milk which is 90% water and once we discover or perfect the remaining 10% that give milk its real taste, we can move away from animal production (full list of companies innovating the 10%).

One of the first burgers to use this technology in 2013 cost $325,000 and two years later the price has dropped to $11. Meatable and Impossible Foods scale this technology further for meat, Mushlabs uses the roots of mushrooms towards the same goal and Just started out aiming for the egg and transitioned to the chicken.

SolarFoods and AirProtein went a step further and are producing salmon or meat from thin air. Originally developed to feed astronauts on long space journeys, the research utilised by the company’s founders uses carbon dioxide and hand bacteria to create non animal protein.

Lastly there’s FoodTech. It is a broader term encompassing farm to fork innovation including ingredients and logistics as well as elements of Bio and AgriTech. BettaFish uses seaweed to create tuna replacement and Qoa uses oat spelts to produce chocolate alternatives (as one chocolate bar takes 1000 liters of water to produce).

Other intersectional solutions include AIs to identify and reduce food wastage in the retail/hospitality sector, optimisations in the food transport and storage space and packaging from more sustainable sources.

The benefit of these solutions, specifically vertical farming and lab grown/alternative meat, are myriad. First, unused urban spaces can be reactivated/repurposed for growing crops. Decentralisation in turn helps save transport, water and land costs as well as fuel usage.

Moving away from livestock also reduces methane emissions and water and land usage. Lastly, foods originating from controlled environments can aid with better inventory control and reduce food spoilage rates.

FoodTech’s hurdles

Three fourths of what the world eats comes from 12 plant and 5 animal sources. If we could proliferate the above solutions and help increase their „staple potential“ (affordability, availability, acceptance, taste..etc), perhaps this could solve the above stated food insecurity (and environmental challenges).

At least for wheat that’s; however, unlikely to happen because energy costs for artificial lighting and commodity market prices make wheat vertical farming economically uncompetitive (despite yielding 220-600 times more than regular production methods).

Market dynamics aside, the hurdles to be cleared ahead of FoodTech are: funding and supportive regulation. First, funding; as with any technology coming out of Europe, more investment in the sector will help it go a long way.

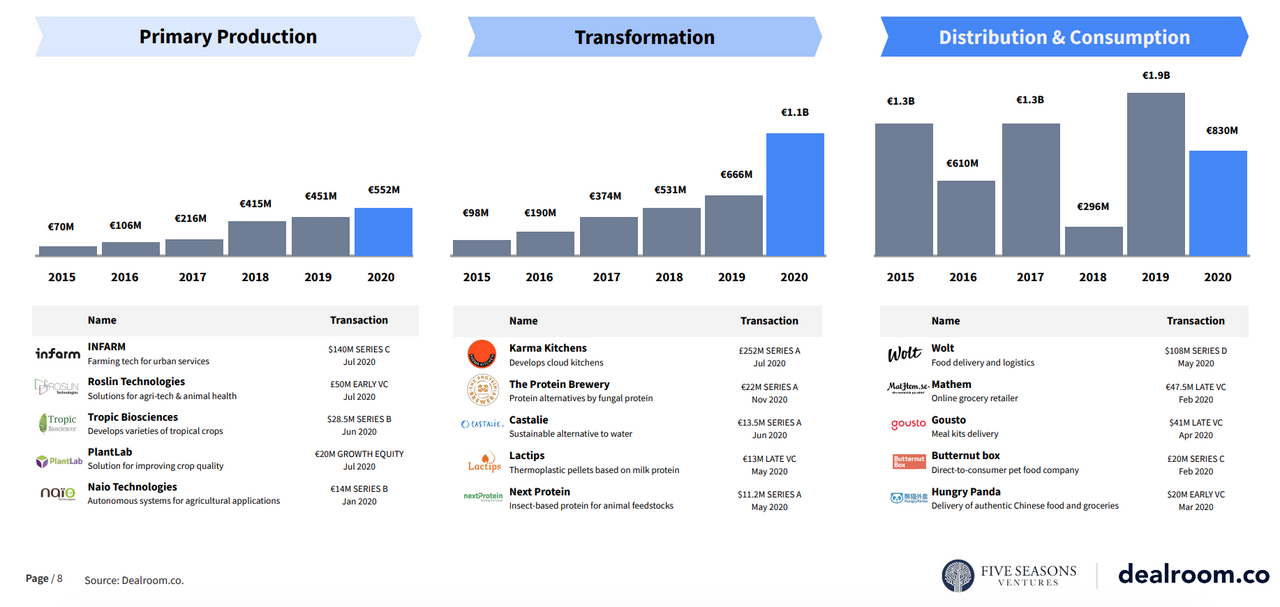

Between 2021–2027 a bit more than 2% of the EU’s total budget for food and agriculture will go to FoodTech research and development (RnD) (€9billion of €386 billion). VC funding has accelerated due to Covid though mostly in the delivery space and meal kit space.

Given how competitive the food market already is, innovation – whether plant based or otherwise – will be met with resistance (e.g. oat drink vs oat milk as a result of cow based industry fighting over product naming). Another aspect is the nutritional quality of new proteins which is one of the big questions around their adoption and emergence.

At the moment these are designed for market acceptance (optimise for taste, texture, cost..etc) and a forward looking regulatory and RnD approach should factor in how to factor this in and improve their nutritional profile (antioxidants, hydrocolloids, prebiotics ..etc). Regulation can also step in in the form of education and helping produce an informed sociotechnical imaginary around food innovation.

🌱💡 If you liked what you read, please subscribe above or tweet @ShiftPrintBlog. Better yet, forward this piece via email to someone who you think might find it interesting! If you have any comments about it, please reach out as well.